Scrapping a car can feel like a weight taken off your shoulders as the money pit is finally taken away, but did you know it’s not just the running costs that you can save on? In some cases, depending on when you scrap your car, you could find that you’re entitled to some money back on both your tax and insurance. Read on to find out if you qualify.

If I scrap my car, can I claim tax back?

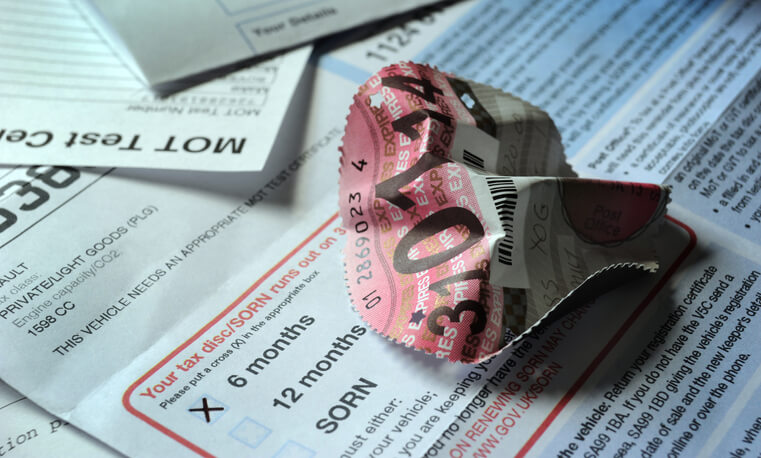

You absolutely can claim any unused tax from vehicles that you have scrapped, or even just sold on. ‘Unused’ tax refers to full months that have not been used by you, and as tax is not transferable from owner to owner, you are entitled to a percentage of your tax payment back. For clarity, a full month means any month where the car will not be used. For example, if you were to scrap your car on the 14th of June and your tax runs out at the end of October, you will be entitled to a refund of four months’ worth of tax – July, August, September and October. June will not count as you have used the tax for those first 14 days. The same applies even if it’s only the 2nd of the month.

How do I claim tax back on a scrapped car

With the government shifting to a wholly online system for tax in 2014, the protocol for gaining a tax refund changed as a result. Prior to 2014 all you had to do was take your old tax disc to the nearest post office and apply for a refund. Now, though, it’s a simple case of applying for a refund on the Government’s own website. Once you have informed the DVLA of your reason for needing a tax refund, they will cancel your car’s tax and any direct debits that may be linked to it, and you’ll be sent a cheque for any full months you had left on your vehicle’s tax.

It’s worth noting that you will not be able to apply for a tax refund if you have already sent your V5 to the DVLA following scrapping your car.

Can I claim back on insurance?

Whether or not you are entitled to a refund on your insurance depends on the way that you pay for your policy. If you pay monthly then you may find that your insurers will just cancel any future payments, meaning you won’t pay any more than you currently have, but won’t receive any in return. However, if you pay for your insurance annually then you may have a case to argue with your insurers and you may be able to claim back a percentage of your original price in line with how far into your policy you are.

Scrapping Made Simple with National Scrap Car

If you’re looking to scrap your car in the quickest and simplest way, then you’re in the right place with National Scrap Car. We’re committed to finding you the very best price for your car, and by using our free online tool you’ll be given unbeatable quotes in as little as 60 seconds. All you need to do is give us your reg number and postcode, and with collections available up and down the country, your car will be gone before you know it. Get started today and find out just how much you could sell your scrap car for.